To transfer funds to yourself to a card issued by another bank, you need to indicate the account details of the recipient’s bank card when making a payment.

An entrepreneur can also transfer money to any individual.

However, you need to know the difference between transfers from a current account to a card for yourself or another person. The law does not establish restrictions on the transfer of money received from the business activities of an entrepreneur.

What accounts can be used to reflect in accounting personal funds deposited and received by an individual entrepreneur from a current account, as well as funds associated with business activities (an individual entrepreneur keeps accounting records)? Is it possible to use count 75 in this situation?

The funds that an individual entrepreneur transfers to the settlement account opened for him to carry out business activities, from his personal accounts, cannot be recognized as income, since they are not related to payments for sold goods (work, services) or property rights (see also the letter from the Department of Tax Administration of Russia by city

Moscow dated April 17, 2002 N 11-17/17692). Accordingly, the return of these funds to the entrepreneur will not be an expense.

How to cash out money from an individual entrepreneur’s current account legally in 2018

Considering the complexity of processing cash transactions and the need to pay a commission to the bank, we recommend making cash payments to counterparties and employees in extreme cases.

As for withdrawing cash for personal needs of an individual entrepreneur, this is easier to do.

Individual entrepreneur account

And at the end of the month, the amount that the individual entrepreneur took from the business is attributed to other expenses. Debit 76, subaccount “Settlements with an individual entrepreneur”, Credit 50(51) Debit 91, subaccount “Other expenses”, Credit 76, subaccount “Settlements with an individual entrepreneur” Question About the possibility of an individual entrepreneur applying the simplified tax system with an income object (41 kB) Article How entrepreneur to take money from business to personal (75 kB)

Individual entrepreneur transfers money to his card, how to reflect this in the transaction

Recognition of income in the form of dividends (income from equity participation) is reflected in the debit of account 76, subaccount 76-3, and credit 91 “Other income and expenses”, subaccount 91-1 “Other income” (Instructions for using the Chart of Accounts).

Next, the individual entrepreneur transfers his “income” from his current account to his personal account in another bank. Payments to suppliers can be made in cash and through a bank account. Transactions with “real” money are limited to an amount of 100 thousand.

How to transfer money to an individual entrepreneur’s current account and reflect it in accounting

Also, the transfer of funds is necessary for settlements not only with clients, but also with suppliers.

Although having a settlement account for individual entrepreneurs is not mandatory in our country, it makes financial transactions much easier. As an advantage, it can be noted that you can transfer money to current accounts without thinking about restrictions: there are no restrictions on the amount.

Accounting entries for private equity assets ->

Accounting entries for private equity assets

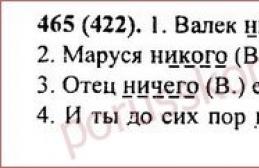

Dt 75 Kt 51 - it seems not entirely reasonable, since according to the chart of accounts this is an account of settlements with the founders, and founders are only in organizations - SO IT IS OBLIVATED.

Dt 76 Kt 51 - quite possible, but is it correct?

Put your own funds as an individual entrepreneur for settlements with different debtors and creditors? I think not!

SO IT'S AWAY

Dt 84 Kt 51 - Retained earnings? For example, 84.03 “Undistributed profits in circulation” add the subaccount “Individual’s own funds” When he carries his money, we make a posting Dt 51 Kt 84.03, removes Dt 84.03 Kt 51.

When you deposit D50 K84, and then hand over D51 K50 to the bank.

I think there can be no way to be right here. Accounting for individual entrepreneurs does not fit into the accounting rules. Neither the plan nor any accounting regulations provide for such operations, because they were not written for individual entrepreneurs.

And for yourself you can bet on any account, although for example I use 86 on 00.

Not because it’s right, but it’s just more convenient for me.

Home — Consultations

How does an individual entrepreneur spend money on personal needs?

How much money can an entrepreneur spend on himself?

What documents do I need to fill out to take money from the cash register for personal needs? How to reflect purchases in accounting if the entrepreneur paid for them with personal money?

On June 1, 2014, Directive of the Bank of Russia dated October 7, 2013 No. 3073-U “On cash payments” (hereinafter referred to as Directive No. 3073-U) came into force. This document officially allowed individual entrepreneurs to spend money from the cash register for their personal needs (previously, this possibility also existed, but was not directly stated in the instructions of the Central Bank).

At the same time, also from June 1, 2014, individual entrepreneurs are allowed not to draw up a cash book and cash receipts and debit orders. This is established by the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U “On the procedure for conducting cash transactions...”.

Note. Until June 1, 2014, individual entrepreneurs had to be guided by Bank of Russia Directive No. 1843-U dated June 20, 2007 (hereinafter referred to as Directive No. 1843-U).

From this article you will learn how you can document spending money on personal needs, taking into account all these nuances.

An individual entrepreneur can spend any amount for personal needs

An entrepreneur is the full and sole owner of the business. And he has the right to dispose of the money received from conducting activities and remaining after paying taxes at his own discretion (Article 209 of the Civil Code of the Russian Federation). It turns out that you have the right to take money from the cash register at any time and spend it on personal needs. For example, to buy a gift for a relative. This conclusion is now confirmed not only by the provisions of paragraph 1 of Article 861 of the Civil Code of the Russian Federation, but also by Directive No. 3073-U, which has entered into force.

Previously, Directive No. 1843-U did not contain direct permission for such expenses. And the Central Bank, in its letter dated August 2, 2012 No. 29-1-2/5603, explained that entrepreneurs have the right to spend cash on personal needs without restrictions. However, this applied exclusively to money withdrawn from the current account. Therefore, many businessmen doubted the legality of spending cash proceeds for personal purposes. Now there is no doubt about the legality of such operations.

As for the amount of money you can spend on personal needs, there is no limit to it. This means that to pay for personal expenses (not related to running a business), you have the right to take as much money from the cash register as you need at any time.

How to withdraw money from the cash register for personal needs

So, from June 1, 2014, individual entrepreneurs may not maintain a cash book and not draw up cash documents (clauses 4.1 and 4.5 of the Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U). This relaxation applies to all individual entrepreneurs, regardless of the taxation system. We talked about the pros and cons of refusing to prepare cash documents in a separate article on p. 16. Please note that in order to exercise the right not to issue “prikhodniki” and “consumables”, you need to issue a corresponding order, a sample of which is given in the previous article.

When to comply with the cash payment limit

Entrepreneurs, when concluding business transactions with organizations and other entrepreneurs, must comply with the cash payment limit. Currently it is 100,000 rubles. and applies not only during the validity period of the agreement, but also after the expiration of its validity (clause 6 of Directive No. 3073-U). For example, if after termination of the lease agreement the tenant has a debt, then he will be able to repay this debt in cash only within 100,000 rubles. taking into account all previous cash payments under this agreement.

Failure to comply with the limit of 100,000 rubles for cash payments. may result in an administrative fine in the amount of 4,000 to 5,000 rubles.

(Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

Note that earlier in Directive No. 1843-U it was not stated that the limit of 100,000 rubles. is valid even after the expiration of the contract. However, the Bank of Russia itself, in its official explanations, explained that the ban on cash payments in amounts exceeding 100,000 rubles applies to the fulfillment of obligations both during the validity period of the agreement and after its expiration. About this is the official explanation of the Bank of Russia dated September 28, 2009 No. 34-OR. The tax service also agreed with the Central Bank (letter of the Federal Tax Service of Russia dated June 10, 2011 No. AS-4-2/9303@).

And if you have issued such an order, in order to spend cash on personal needs, you do not need to draw up any documents at all. You will not officially record the receipt or expenditure of cash. You can keep personal records in your notebook. If you come to the conclusion that it is more expedient for you to continue maintaining cash documents, then to issue money from the cash register for personal needs, issue a cash expenditure order in form No. KO-2 (approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88). As the basis for the payment in such a document, you can indicate either “Issuance of funds to the entrepreneur for personal needs” or “Transfer of income from current activities to the entrepreneur.” Then do not forget to reflect the written out “consumables” in the cash book. Its unified form No. KO-4 was approved by Decree of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

Example 1 . IP Selenin R.V. I was planning to go on vacation with my wife. To pay for the trip, he took money from the cash register in the amount of 65,000 rubles. A sample of filling out a cash receipt order is shown below.

How to register a cash purchase in accounting

Entrepreneurs rarely separate money into those used in business and those intended for personal needs. Especially now that it is allowed to freely withdraw any amount of cash for personal spending. Therefore, a situation may arise where you paid for a purchase necessary for your business with your personal money. Can these costs be taken into account for tax purposes? Let's figure it out.

According to paragraph 1 of Article 221 of the Tax Code of the Russian Federation, in order to account for expenses as part of the professional deduction for personal income tax, expenses must actually be incurred and documented. In addition, they must be directly related to generating income. Documents confirming expenses will also be required if you apply the simplified tax system with the object income minus expenses. How to arrange all this?

Regardless of whether you conduct cash transactions or not, you, as an individual entrepreneur, do not need to give yourself money on account. Because they are all yours anyway. The Central Bank of Russia announced this two years ago in a letter dated June 14, 2012 No. 29-1-2/4255. Issuing accountable amounts is only relevant if your employees buy something.

Accordingly, you personally do not need to formalize the purchase of valuables using an advance report, as, for example, your employee would do. You just need to take into account those documents according to which the property (work, services) needed for the business was paid for. Having made entries in the Accounting Book.

For tax accounting of expenses, a cash receipt, invoice or sales receipt is sufficient. This requirement is relevant if you pay personal income tax or apply the simplified tax system (object - income minus expenses).

If you use UTII, the patent system or the simplified tax system (object - income), then documents confirming expenses are no longer particularly relevant. After all, you don’t take tax expenses into account and don’t keep accounting records.

June 2014

How can an individual entrepreneur receive his income from business activities?

How can an individual entrepreneur receive his income from business activities?

Tax accounting entries under the simplified tax system

Tax accounting entries under the simplified tax system We have collected all the most common mistakes when calculating a single tax, read the questions and advice from regulars, and prepared a cheat sheet for you: how to correctly reflect the tax under the simplified tax system using entries?

Entrepreneurs who apply the “simplified tax” pay one instead of three main taxes (profit, property and value added):

- or 6% of total income for 12 months;

- or 15% of the difference between income and expenses, but not less than 1% of the total.

The percentage charged under the “” taxation scheme is unchanged.

Postings for payment of income of an individual entrepreneur

Discussions 26 messages If accounting is still carried out, then, in our opinion, in this case you can use account 75 “Settlements with founders”.

In accordance with the explanations to the specified account, information on the presence and movement of all types of settlements with founders for payment is summarized on account 75. Payment of intermediate income is reflected in the debit of account 84 “Retained earnings” and the credit of account 75 “Settlements with founders”.

How can an individual entrepreneur get his money from entrepreneurial activity?

Please clarify which part of the article allows you to draw such a conclusion? An individual entrepreneur can freely manage his money from business activities, regardless of whether he has employees or not.

Can anyone tell me what entries in correspondence with 51st should be generated?

Payment of income to individual entrepreneurs - when is an organization a tax agent for personal income tax?

Payment of income to individual entrepreneurs - when is an organization a tax agent for personal income tax?

Personal income tax on the income of an individual entrepreneur received from an organization - who should pay it: an entrepreneur or an organization? In Art. 227 of the Tax Code of the Russian Federation seems to clearly state that the individual entrepreneur himself must pay this tax. But there are exceptions to this rule, which we will discuss in our article.

In accordance with Art. 227 of the Tax Code of the Russian Federation, individual entrepreneurs and other persons engaged in private practice independently calculate and pay personal income tax in relation to income received from business or professional activities.

Payment of personal income to an entrepreneur

payment of personal income to an entrepreneur payment of personal income to an entrepreneur Well, it will even be fun, so what, after all, accounting is only for individual entrepreneurs personally, and he wants to know how much he spent on himself!

I think what is important here is not the wiring, but the concept of the meaning of the operation.

Probably all such desires to create unnecessary postings for individual entrepreneurs arise when using the wrong software.

Funds are credited in a few minutes.

To transfer funds to yourself to a card issued by another bank, you need to indicate the account details of the recipient’s bank card when making a payment.

An entrepreneur can also transfer money to any individual.

However, you need to know the difference between transfers from a current account to a card for yourself or another person. The law does not establish restrictions on the transfer of money received from the business activities of an entrepreneur.

How to withdraw money from an individual entrepreneur's current account? Individual entrepreneur withdraws money from the current account: transactions

Opening a bank account is more profitable than making all payments through a cash desk. We list the main advantages: Withdrawal of funds Transaction purposes For personal needs

What accounts can be used to reflect in accounting personal funds deposited and received by an individual entrepreneur from a current account, as well as funds associated with business activities (an individual entrepreneur keeps accounting records)? Is it possible to use count 75 in this situation?

The funds that an individual entrepreneur transfers to the settlement account opened for him to carry out business activities, from his personal accounts, cannot be recognized as income, since they are not related to payments for sold goods (work, services) or property rights (see also the letter from the Department of Tax Administration of Russia according to Moscow dated April 17, 2002 N 11-17/17692). Accordingly, the return of these funds to the entrepreneur will not be an expense.How to withdraw money from an individual entrepreneur’s current account legally in 2019

Next, the received cash must be entered into the individual entrepreneur's cash register using a cash receipt order (PKO), and then issued from the cash register using a cash outflow order (RKO).Considering the complexity of processing cash transactions and the need to pay a commission to the bank, we recommend making cash payments to counterparties and employees in extreme cases.

As for withdrawing cash for personal needs of an individual entrepreneur, this is easier to do.

Individual entrepreneur account

And at the end of the month, the amount that the individual entrepreneur took from the business is attributed to other expenses. Debit 76, subaccount “Settlements with an individual entrepreneur”, Credit 50(51) Debit 91, subaccount “Other expenses”, Credit 76, subaccount “Settlements with an individual entrepreneur” Question About the possibility of an individual entrepreneur applying the simplified tax system with an income object (41 kB) Article How entrepreneur to take money from business to personal (75 kB) Recognition of income in the form of dividends (income from equity participation) is reflected in the debit of account 76, subaccount 76-3, and credit 91 “Other income and expenses”, subaccount 91-1 “Other income” (Instructions for using the Chart of Accounts).Next, the individual entrepreneur transfers his “income” from his current account to his personal account in another bank. Payments to suppliers can be made in cash and through a bank account. Transactions with “real” money are limited to an amount of 100 thousand.

How to transfer money to an individual entrepreneur’s current account and reflect it in accounting

Also, the transfer of funds is necessary for settlements not only with clients, but also with suppliers.Although having a settlement account for individual entrepreneurs is not mandatory in our country, it makes financial transactions much easier. As an advantage, it can be noted that you can transfer money to current accounts without thinking about restrictions: there are no restrictions on the amount.

Accounting entries for private equity assets ->

Accounting entries for private equity assets

Dt 75 Kt 51 - it seems not entirely reasonable, since according to the chart of accounts this is an account of settlements with the founders, and founders are only in organizations - SO IT IS OBLIVATED.

Dt 76 Kt 51 - quite possible, but is it correct?

Put your own funds as an individual entrepreneur for settlements with different debtors and creditors? I think not! SO IT'S AWAY

Dt 84 Kt 51 - Retained earnings? For example, 84.03 “Undistributed profits in circulation” add the subaccount “Individual’s own funds” When he carries his money, we make a posting Dt 51 Kt 84.03, removes Dt 84.03 Kt 51.

When you deposit D50 K84, and then hand over D51 K50 to the bank.

I think there can be no way to be right here. Accounting for individual entrepreneurs does not fit into the accounting rules. Neither the plan nor any accounting regulations provide for such operations, because they were not written for individual entrepreneurs.

And for yourself you can bet on any account, although for example I use 86 on 00.

Not because it’s right, but it’s just more convenient for me.

Experienced entrepreneurs know that depending on the tax regime they choose, they are subject to reporting duty.

The procedure for maintaining documentation is very important, since tax and other government authorities have the right to request one or another document to clarify circumstances or provide benefits and privileges. Lack of reporting or incorrect reporting results not only in restrictions on claiming various state rights, but also in prosecution and the imposition of fines.

Necessity

Individual entrepreneurs, not being legal entities, have a number of “indulgences” when carrying out activities, but the legislation strictly regulates the procedure for maintaining records on a par with enterprises.

Individual entrepreneurs, not being legal entities, have a number of “indulgences” when carrying out activities, but the legislation strictly regulates the procedure for maintaining records on a par with enterprises.

Accounting is necessary, first of all, for the tax authorities to check the correctness of calculation of fiscal payments. Also, a similar method of organizing records of expenses and income ensures orderliness and discipline of finances, own control over the movement of funds, the ability to plan and forecast, assess the effectiveness of activities and the dynamics of profits and losses by period, etc.

No. 402-FZ states that individual entrepreneurs are not required to maintain this type of accounting. However, the Tax Code in some cases requires business individuals to have financial statements in the form of recording income and expenses. Thus, the legislation does not incriminate private individuals with obligations to do so, but the right of choice is retained - if the subject considers this form of document flow appropriate, he can apply it. The second element of choice is the degree of complexity of accounting - full or simplified.

The procedure for generating documents in a simplified mode is regulated the following acts:

- Order of the Ministry of Finance of Russia of 1998 No. 64n, containing the recommended organization of simplified accounting for small businesses;

- Order of the Ministry of Finance of Russia No. 3/2015, the text was published on the Ministry of Finance website in June 2015.

It should be remembered that the Tax Code also provides for tax accounting, which in some systems even individual entrepreneurs are required to carry out. The legislation has long been discussing the issue of bringing accounting and tax accounting to unity, but today the difference between them is still large.

Step-by-step instructions for 2018

The easiest way to do bookkeeping is hiring a document management employee, specializing in both accounting and tax legislation, or contacting audit firms.

If such opportunities are not available, you can organize the correct preparation and completion of all necessary documents on your own.

Entrepreneurs who are just about to open a business and want to establish a clear documentary system from the very beginning, as well as individuals who are already engaged in business and decide to keep accounting records, must go through several stages.

Preparation- it is required to perform preliminary calculations of income and expenses. It will be more difficult for novice subjects to determine the results of their activities. As a basis, we can consider the basic profitability determined by the legislation on imputed tax and - if the activity corresponds to one of the types in the lists. Also, to assess profits and risks, one should consider the financial results of entrepreneurs in their locality.

If it is possible to find out the profitability and profitability of economic objects near their own, entrepreneurs who have worked before use data from records of income and expenses that they have kept since the beginning of work. The entire calculation is necessary for the optimal execution of the next preparatory stage.

- firstly, the presence or absence of an obligation to also keep tax records depends on this, and secondly, different regimes are suitable for different types and turnover of activities. For example, a small business can be run on any special system due to compliance with all limits.

- firstly, the presence or absence of an obligation to also keep tax records depends on this, and secondly, different regimes are suitable for different types and turnover of activities. For example, a small business can be run on any special system due to compliance with all limits.

With a large-scale business and large amounts of profit, entrepreneurs will be able to work only on a simplified system or even on the main mode. To make the right choice, you should calculate the tax for each regime and take into account the amount of profit, benefits and deductions provided. Thirdly, each of the systems has its own types and frequency of reporting:

- for “imputed” - a quarterly declaration;

- patent entrepreneurs are not required to submit reports, but they must keep a book of income and expenses, which also does not need to be submitted to the Federal Tax Service, but the tax authorities have the right to request the document during an audit;

- “simplified” people have been required to keep accounting records since 2013, however, individual entrepreneurs are an exception to this norm and must only keep tax records - to fill out a declaration;

- under the general regime, declarations for all taxes are submitted, but according to the basic rule, entrepreneurs are exempt from accounting and are limited to conscientiously filling out a book of income and expenses.

Accounting for the presence or absence of employees- all employers are insurers of officially employed employees, due to which they are responsible for a large amount of reporting on insurance payments, not only to the Federal Tax Service, but also to extra-budgetary state funds. The frequency of submission of some types of documents is every month, which requires filling out and storing personnel documents. Ignoring this responsibility will result in liability and fines.

Drawing up an individual tax calendar for your business- various deadlines for submitting reports and paying taxes require careful verification of the dates, since each delay entails fines and penalties. The largest number of reporting dates are placed on the calendar.

Software installation- it is known that the most optimal way to maintain double entries is 1C.

Study of regulations— No. 402-ФЗ, regulations on accounting, rules for organizing tax accounting under Chapter 25 of the Tax Code, personnel documentation, in retail - cash legislation, which underwent significant changes in 2016, standard forms and forms and general rules for filling out various documents - graphic and visual design, structure, details, wording. It is recommended to order a personal seal of the individual entrepreneur with INN and OGRN numbers.

It is also convenient to conclude an agreement with an EDF operator to obtain a digital signature and establish a remote communication channel with the Federal Tax Service. In reality, doing business and handling documentation on your own is difficult, even physically, so it is advisable to hire a document manager or accountant to assign responsibility for accounting, reporting, and personnel matters.

The main taxes of this system for entrepreneurs are personal income tax, VAT, property tax and, probably, insurance premiums. Cases when an individual entrepreneur chooses the general regime are rare, since it has the largest volume of requirements for the calculation, payment and reporting of taxes.

The main taxes of this system for entrepreneurs are personal income tax, VAT, property tax and, probably, insurance premiums. Cases when an individual entrepreneur chooses the general regime are rare, since it has the largest volume of requirements for the calculation, payment and reporting of taxes.

As a rule, the reasons for choosing this system are working with counterparties for VAT refunds or the inability to comply with the limits of special regimes.

For personal income tax, annual declarations are submitted, as well as in some cases 4-personal income tax and 6-personal income tax. A 2-NDFL certificate about employee income and withheld taxes is also submitted.

For insurance premiums, a single calculation is submitted to the tax office and form 4-FSS to Social Insurance.

VAT refund operations are subject to the greatest control by tax authorities - firstly, all reporting is submitted only in electronic form, so individual entrepreneurs will have to work according to the TKS. Secondly, on-site inspections are often initiated for this tax - you need to ensure that all documentation is strictly maintained in case of such an event.

IP on the simplified tax system

A special feature of the regime is the presence of two accounting systems - for income and for profit.

One declaration is submitted per year - its new form is posted on the Federal Tax Service website nalog.ru.

It is easier to keep tax records with income, since expenses do not play a role at all in the final amounts.

When working with profit, you must be guided by the basic principles of Chapter 25 of the Tax Code.

Report submission deadlines

| Mode | 1st quarter | 2nd quarter or half year | 3rd quarter or 9 months | 4th quarter or year |

|---|---|---|---|---|

| General system | VAT declaration - until April 25 Single payment to the Federal Tax Service - until April 30 4-FSS - until April 20 or 25 6-NDFL - until April 30 | VAT declaration - until July 25 EP - until July 30 4-FSS - until July 20 or 25 6-NDFL - until July 30 | VAT declaration - until October 25 EP - until October 30 4-FSS - until October 20 or 25 6-NDFL - until October 30 | Personal income tax declaration - until April 30 VAT declaration - until January 25 2-NDFL - until April 1 SSC - until January 20 Certificate confirming the type of activity in the Social Insurance Fund - until April 15 4-FSS - until January 20 or 25 EP - until January 30 6-NDFL - until January 30 |

| simplified tax system | Reporting is not submitted | Reporting is not submitted For employees - similar to OSNO | Reporting is not submitted For employees - similar to OSNO | Declaration - until April 30 For employees - similar to OSNO |

Programs

1C Entrepreneur software will greatly facilitate the organization of accounting and reporting. In any case, no one has been using manual accounting for a long time due to the labor intensity, costs, inconvenience of searching and organizing information; with manual accounting, you will have to create a separate room for the archive, since the number of paper media will grow with each reporting period

Postings for depositing own funds into the account

Without accounting, an entrepreneur only needs to issue an incoming cash order to add personal funds to the cash register, and then an outgoing order to transfer them to the current account.

In the case of accounting, the entries are as follows:

- Dt 50 Kt 72.1- depositing funds into the cash register (account 72.1 - investment of personal funds);

- Dt 51 Kt 50- transfer from the cash register to the account.

Simplified methods of accounting are presented in this video.

When carrying out entrepreneurial activities, situations often arise when an entrepreneur or your personal funds(not related to the receipt of revenue or other income from activities), or, conversely, uses funds from his checking account to make non-business related payments.

Topping up your current account

It’s not always possible: it’s easier to entrust large sums to a bank, it’s often more convenient to pay with companies by bank transfer, and when the partner is in another city, a current account will speed up the payment process. Therefore, merchants open business accounts, although the law does not require them to have a current account.

If for his work (services) a businessman accepts payment from customers not only in cash, but also by bank transfer, for example, an individual entrepreneur carries out retail trade and rents out part of the unused space, the rent may well be asked to be transferred to a bank account. In this case, certain amounts will be in the account and you can use them to pay your partners or pay taxes. But often there are not enough funds or the individual entrepreneur prefers to leave a minimum amount in the account in order to prevent inspectors from freezing the account in case of non-payment of tax or failure to submit a declaration.

Inspectors often include in a businessman’s income cash deposited by the businessman into his own account and charge additional taxes on this amount.

In this situation, it is necessary, first of all, to understand that any property, both used in the citizen’s business activity and not used in the activity, is owned by the same person - this very citizen. The law does not establish any boundaries for entrepreneurs.

According to Art. 41 of the Tax Code, income is recognized as economic benefit in cash or in kind. In ch. 23 “Income Tax for Individuals” and 26.2 “Simplified Taxation System” establishes the procedure for calculating the taxable base (the amount on which tax is paid) for individual entrepreneurs under the general regime and the simplified tax system. In both cases, the tax is calculated based on income.

Our information. UTII is calculated based on other criteria and is in no way tied to the amount of income of a businessman. But controllers may indicate that the amounts deposited into the current account are not related to “imputed” activities, which means that these supposed incomes should be subject to personal income tax, and if a businessman combines UTII and the simplified tax system, then a single tax must be paid on the “income” according to the simplified tax system . So the problem may also affect the “imputed” people.

When a merchant deposits his personal funds into his current account the owner of the funds does not change, therefore no no economic benefit (income) arises, and therefore, the entrepreneur does not have either income or a tax base. Moreover, current legislation does not oblige individual entrepreneurs to open a bank account. It is all the more obvious that no transfer of an entrepreneur’s personal funds from cash to non-cash form does not generate an object of taxation.

Often the situation is aggravated by the fact that bank employees, when depositing cash into an individual entrepreneur’s current account, require that the announcement for a cash deposit indicate as the basis for the deposit: “revenue from business activities” or similar wording, explaining this by saying that “there is no other basis for depositing cash.” they don’t have a provision for the account.” It is difficult to convince bank employees, however, there is no need to mention revenue in the payment slip, especially since the funds are not such.

In such cases, arbitration practice has developed, and what is pleasant is in favor of taxpayers. Thus, from the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated September 6, 2005 N 2746/05, issued in favor of the taxpayer, it follows that the inspection is obliged to prove that the proceeds to the account are income from business activities. Depositing funds into a current account by the merchant himself does not at all prove that the funds are his income. The fact of subsequent use of funds in payments for goods does not in itself indicate the legality of classifying such funds as income from business activities. In other words, the fact that an individual entrepreneur spends money on business development does not mean that it is his illegal income, on which tax has not been paid. This may be the citizen’s savings for the period of work under an employment contract before registration as an individual entrepreneur. Controllers must prove that the funds deposited by a citizen into his business account are unaccounted income, and this is very difficult to do.

Our information. If inspectors consider the personal money of an individual entrepreneur, deposited by him into his own current account, as income and charge additional taxes, the inspectors’ decision can be challenged. The court will require inspectors to provide evidence that the money is indeed income; inspectors are unlikely to provide such evidence. Inspectors can request from the individual entrepreneur a book of income and expenses, and other documentation (the request must be in writing and is possible only during an inspection, including a counter inspection; in other cases the individual entrepreneur is not obliged to fulfill it). But the amounts are not indicated in the papers, because they are not income, so the businessman’s documentation will not become an argument against him.

In favor of the businessman in a similar case, the Supreme Arbitration Court of the Russian Federation of December 9, 2009 No. VAS-16440/09 was issued: “the inspection did not provide evidence that the cash deposited by the entrepreneur into an account with a credit institution is income received from them entrepreneurial activities, and therefore the inspectorate had no grounds for charging value added tax, personal income tax, unified social tax, penalties and fines."

The Federal Arbitration Court of the West Siberian District in its Resolution of July 22, 2009 N F04-4357/2009 (10909-A45-42) indicated: the fact that “trade proceeds” is indicated as the source of money deposited into the current account is not sufficient grounds for including these amounts in income, since the entrepreneur stated that these were his personal funds, but the tax office did not provide evidence that these funds were income from activities.

To avoid problems with inspection, merchants sometimes indicate “borrowed funds” as the basis for depositing funds. However, from our point of view, such a solution to the problem is not entirely advisable. Borrowed funds require the presence of a lender. A contract made with oneself or a spouse will obviously be invalid. The property of the spouses is common, and you cannot borrow from yourself. Do not confuse an entrepreneur with a businessman who has registered an LLC and is the only founder there. The property of a legal entity is separate, and the individual founder can provide a loan to the company. In this case, the agreement will include the same surname of the person who registered the company, but it will act in different guises: the lender is an individual, and the borrower is an organization represented by its founder (this individual). An entrepreneur will not be able to draw up such an agreement, since the lender and recipient will be a citizen.

Enter into an agreement with an outsider to deposit money into a current account with the basis "borrowed funds" is not worth it, since problems may arise in the future if this person demands a refund. Even if there is a receipt immediately received from him for the return of funds with an open date, the entrepreneur may have significantly more problems than from communicating with the tax office.

So, an entrepreneur can freely deposit personal funds into his current account without paying any additional taxes. The only additional advice is to insist to the bank that the basis for the deposit be indicated: “depositing personal funds”, “replenishing a current account”, “replenishing a business account from personal funds”, “transfer of own funds” or other wording similar in meaning. In the event of subsequent disagreements with the tax documents, copies of the filing documents will serve you as additional evidence of the correctness of the chosen position.

Non-cash expenses of a citizen

The opposite situation: a citizen uses money from a current account used in his business for his personal needs. After all, all the money belongs to the citizen; he may well transfer funds from the account to various organizations for purposes not related to the activity, for example, paying for a tour package or repaying an individual’s obligations on loans not related to the activity. In this situation the individual does not have any income, and therefore no taxable base for personal income tax, because the owner of the funds does not change.

How to carry out such an operation? Obviously, there is no point in withdrawing cash from the account and then transferring it to other organizations (or the same bank to repay a citizen’s loan), also paying a commission for transferring funds as an individual. In a rare bank, the commission for cash withdrawal is less than one percent (and often significantly more), plus, as a rule, you will have to pay from one to three percent for transferring these funds from an individual.

Meanwhile, when paying directly from the account, the commission is unlikely to exceed several tens of rubles. These are the funds of a businessman and a citizen rolled into one, so it is quite possible to spend them both on business and for personal purposes. The only thing worth recommending is to carefully follow the wording in the purpose of the payment so that the recipient can easily identify for whom and for what purpose the money came to him, and also to prove in a dispute where the funds were transferred from the account. Clear wording in the purpose of payment is especially relevant when payment is made not for the obligations of the citizen himself, but, for example, for a loan issued to his spouse. This is quite possible.

The property of the spouses (in the absence of a marriage contract) is their joint property; nothing prevents the entrepreneur from paying for the obligations of the other spouse from the entrepreneur’s account. These amounts will not become the income of the spouse, as is expressly stated in paragraph 5 of Art. 208 Tax Code. Thus, an entrepreneur can freely make payments from his current account for children, grandchildren, brothers (sisters), and grandparents. These persons will not receive income as a result of such transfers if these transfers are not related to payments to these persons under employment or civil labor contracts.

Check or card?

When withdrawing cash from a current account, a merchant can use a checkbook or transfer money to a plastic card. Let’s say right away that you can save significantly when withdrawing cash in the second case. Indeed, why withdraw cash from your current account by check and pay a commission, usually at least 1 percent, if, having paid several tens of rubles for a payment order, you can transfer funds to your card or to the card of family members, and then pay with it without any commissions or withdraw funds from an ATM of the same bank.

Sometimes you can issue a plastic card for the account itself. But if not, then you can always open a deposit in the same bank for an individual and link a plastic card to the deposit, or transfer funds from your current account to your plastic card in any other bank.

Both when withdrawing cash from a current account for personal needs and when transferring it to a card, the entrepreneur is free to formulate the basis for withdrawing funds. For example, you can indicate: “withdrawal of funds for personal needs” or other similar wording. When transferring to a card, you can indicate: “Replenishment of a plastic card” or “Replenishment of a plastic card N 123. Card owner A.S. Ivanov is not subject to VAT.” Specifying the number and owner of the card, VAT is not required at all, but sometimes merchants in the general mode prefer to play it safe by providing as much information as possible about the transaction.

A businessman needs to remember that no matter in what form the entrepreneur’s money is stored: on a current account, on a card or in a wallet in his pocket, a businessman can use it at any time dispose of in any way at your discretion:

- replenish your current account in cash or non-cash;

- withdraw cash from your account either by check or transfer it to your card (in the bank where the account is opened or in another bank) or the card of close relatives;

- pay directly from the current account any of your expenses or expenses of your family members.

The wording of the basis for the payment used when making such payments is not of fundamental importance, and the payments themselves will not lead to the emergence of income for the individual entrepreneur, and, consequently, the object of taxation.

Sometimes an individual entrepreneur needs to deposit personal funds into the cash register. Is it possible to contribute your own funds to the company’s turnover? Let's figure out in what cases you can invest your money in an individual entrepreneur's cash register and how to register the receipt of funds.

During the entire period of business, each individual entrepreneur may have several reasons why he will have to deposit his money into the cash register.

The reason may be:

- financial support for your own business;

- replenishment of the current account;

- debt repayment.

If finances are not enough, then an individual entrepreneur can contribute money to his personal account from his own savings. In any case, you need to take into account the subtlety of the execution of this monetary transaction, because you need to draw up the correct ones for the tax office.

When depositing his own money into the cash register, an individual entrepreneur must accompany such payment with an indication that confirms the legality of this operation.

For example, a payment can be signed as:

- “Replenishing your account with personal savings.”

- “Depositing your own finances into your account.”

In this case, the execution of a monetary transaction is carried out taking into account the regulations of the Central Bank of the Russian Federation.

Depositing funds for settlements with employees

An individual entrepreneur has the right to deposit his own funds into the cash register and for. At the same time, it is very important to correctly reflect the value of the receipt of this money in the book of income and expenses (KUDiR). In this case, you must save all bank receipts.

As soon as the funds arrive in the appropriate account, the payment of salaries to employees will be carried out in accordance with the documents used, which confirm the legality of such financial transactions.

Accounting

The entrepreneur’s personal funds, which he decided to deposit in the cash register, can be considered as revenue. Therefore, you need to immediately issue a receipt order. And it should be noted that these finances are not related to the activities of the individual entrepreneur, and also reflect the purpose of the payment.

The entrepreneur’s personal funds, which he decided to deposit in the cash register, can be considered as revenue.

When filling out a debit order, it is also important to indicate the bank account number to which the transferred amount will be credited. It is also worth writing down the address of the bank where the transfer was made.

When depositing money at the cash desk, it is very important to complete the documentation correctly. Namely, it is correct to indicate where this money came from. An individual entrepreneur can deposit cash only into his personal bank account. Otherwise, the bank may refuse.

Upon completion of the operation, the individual entrepreneur will receive a check stamped and signed by the cashier. After completing the operation, you need to make transactions; in our case, you need to use account 84 (“Other operating expenses”).

It is necessary to indicate the purpose of money in a cash receipt order (PKO) only when money received from business activities is deposited into the cash register. In this case, they must be registered as proceeds. Each wiring, regardless of type and purpose, must be documented with the necessary documentation.

When an individual entrepreneur has a debt and deposits money into the account in order to pay it off, it is necessary to issue a PKO. The entire amount that was invested is not taken into account in the KUDiR.

When investing your money in the cash register, you must use the following entries: 72 “Income/expenses of individual entrepreneurs”, 72.1 “Deposit of personal funds”, 72.2 “Replenishment of the account” and 84 “Other operating expenses”.

Taking into account the nuances that relate to the correct execution of various types of documents, it is worth noting that the contribution of personal money to the cash desk should be supported by warrant No. Ko-1. Only in this case, financial accounting of funds deposited in the cash register will be kept in the account that reflects work with creditors and debtors (Debit 76, Credit 50), as well as in the posting account.

What about taxes?

Typically, the individual entrepreneur who uses the simplified tax system deposits funds into his bank account to pay the office landlord. And the question of writing off tax from the payment amount is also very acute for him.

The individual entrepreneur who deposits his funds into the account is not the person forming the tax base. And his own money is not recognized as income, since it is not directly related to the sale of goods or the provision of any services.

An individual entrepreneur has the right to spend any amount for his own needs, including replenishing the company’s current account from his own pocket. But in this case, you need to prepare the appropriate documents. And if the tax office receives a request-claim regarding a specific payment, then send there a document that states all the amounts of funds received and their purpose.